“NOT FOR PUBLIC RELEASE”

by Sharon Rondeau

(Dec. 17, 2016) — In our last article on the case of late civilian contractor Thomas J. Boyle, Jr., his widow reported that companies from which he purchased life insurance policies before deploying overseas have been dishonest with her in claiming that they have released their entire administrative files to her.

(Dec. 17, 2016) — In our last article on the case of late civilian contractor Thomas J. Boyle, Jr., his widow reported that companies from which he purchased life insurance policies before deploying overseas have been dishonest with her in claiming that they have released their entire administrative files to her.

While Aetna issued a payout based on what Mrs. Boyle says are “undocumented circumstances” occurring on June 19, 2012 at Forward Operating Base (FOB) Kandahar, at least one other insurance company has denied issuing benefits based on a “war risk exclusion.”

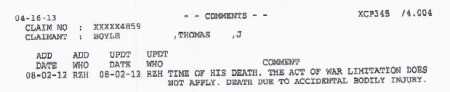

Mrs. Boyle has said that she possesses clear evidence that those companies have withheld crucial information from her stemming from their unwillingness to admit that she was wrongly denied her husband’s death benefits. The evidence includes their own notes in which it is stated that an “accidental” death occurred.

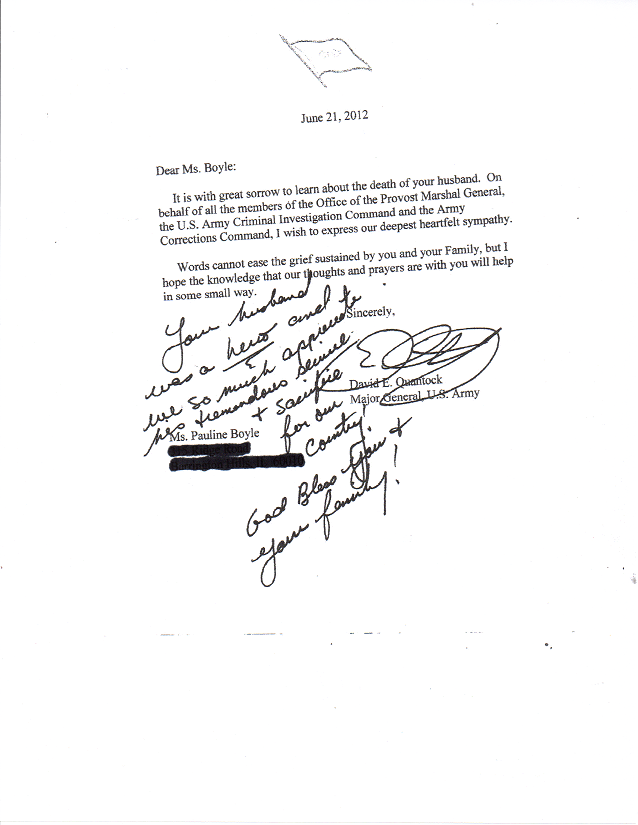

Underlying the “fraud” Mrs. Boyle claims has occurred on the part of the insurers is the U.S. military’s failure to detail to her exactly how her husband was killed. Notably, three different death certificates were issued citing three different causes of death as well as what she claims are false autopsy and investigative reports.

Mr. Boyle was killed by gunfire whose source has not officially been documented. The claim notes from the files of Metlife and Aetna indicate that he died from an “accidental” cause.

Knowing that she was not told the full story, Mrs. Boyle took the significant step of having her husband’s body exhumed and a second autopsy done without military involvement. One finding was that there existed more entrance wounds than exit wounds but no metal fragments were found during the second autopsy.

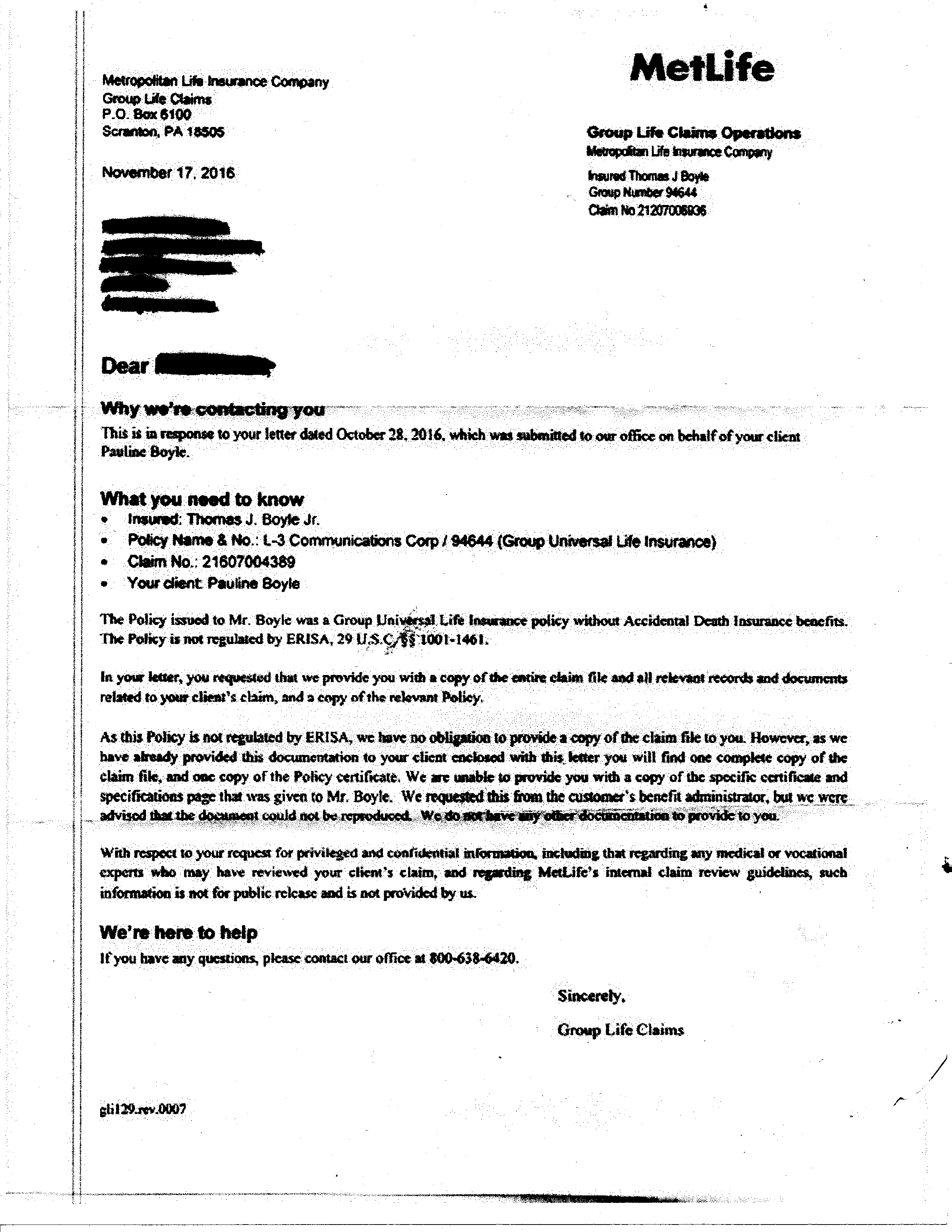

In October, an attorney who had represented Mrs. Boyle for a time made a request to Metlife and all other insurance providers, namely AIG, Marsh, Aetna, and Zurich, for “a copy of the entire claim file and all relevant records and documents related to” Mrs. Boyle’s benefits claim.

In a letter dated November 17, 2016, Metlife responded that it had “already provided this documentation to your client” but indicated that “one complete copy of the claim file” was enclosed as a courtesy.

The unidentified Metlife representative further stated that “privileged and confidential information” “is not for public release and is not provided by us.”

Of the letter her former attorney received, Mrs. Boyle told us, “As you can see once again, Metlife is denying the existence of the Accidental Death policy as well as benefits. Additionally the mention that they have no obligation to provide the claim file to me is ludicrous. I am the beneficiary, as they already know, and as such am entitled to all documents, including those that were used in any decision-making process. This is all a lie. The information by medical and vocational experts who reviewed my claim should have been made available to me. Why, then, was the notation in the Metlife file that states, ‘DOD 6/19/12 was accidental homicide in Afghanistan’? On what report did they base that notation?”

In a November 14 phone call with Kathleen at Metlife, Mrs. Boyle was told that her claim for accidental death benefits was “reopened.” Of that development, Mrs. Boyle told The Post & Email, “The most important part is that when I called Kathleen at Metlife, she stated the claim was reopened for review by Andrew. If there is no accidental death policy what claim did Andrew reopen? Why is there no mention of this in the letter?”