“THE TRUTH ALWAYS COMES OUT; IT’S ONLY A MATTER OF WHEN”

by Sharon Rondeau

(Aug. 23, 2016) — Since the publication of our last article on July 12 on the death of civilian contractor Thomas J. Boyle, Jr. in 2012 and the denial of insurance benefits to his family, his widow, Pauline, has recontacted the seven insurance companies involved as well as her husband’s former employer to ask for complete files, including emails and claim notes.

(Aug. 23, 2016) — Since the publication of our last article on July 12 on the death of civilian contractor Thomas J. Boyle, Jr. in 2012 and the denial of insurance benefits to his family, his widow, Pauline, has recontacted the seven insurance companies involved as well as her husband’s former employer to ask for complete files, including emails and claim notes.

One of the insurers through which Mr. Boyle purchased life insurance before his last deployment overseas was Aetna, which paid a benefit to Pauline on the basis of “accidental bodily injury.” A second company, Metlife, issued a payout based upon “accidental homicide.”

Mr. Boyle, a 30-year retired veteran of the Chicago Police Department and Vietnam War veteran, was part of a unit supporting the 303rd Military Intelligence Battalion stationed in Kandahar Province, Afghanistan when he was killed by gunfire on June 19, 2012. Since that time, Mrs. Boyle has been seeking a full explanation of how her husband was killed and by whom from the U.S. Army as well as benefits from all of the insurance companies which held policies.

An initial report issued by Mr. Boyle’s employer, L-3/Engility, to the U.S. Department of Labor on the day he was killed stated that Mr. Boyle was killed but that more information would be forthcoming. Mrs. Boyle told The Post & Email that the DOL stated that it never received the report, nor was a follow-up report ever generated to her knowledge.

The Army has not issued a definitive statement on the cause of Mr. Boyle’s death, and although Aetna and Metlife paid benefits, the others have denied them, citing a “war risk exclusion.” Therefore, Mrs. Boyle has been seeking the “complete administrative file” from all of the companies involved, to include all emails and claims notes, but has been told that complete records have already been provided.

Of the two companies which paid benefits, Mrs. Boyle told The Post & Email, “They did have claim notes, which took me over a year to get and still are incomplete. They did not willingly supply me any of this information. Had the military, from the onset said, ‘This is what happened; we are so, so very sorry for your loss; your insurance will be paid; how else can we help you?’ I would have had no recourse or complaint. There is nothing I could have done had they come forward. But now we have insurance fraud; they’re hiding a criminal act, and the order to do so goes all the way to the top of the military (The Brotherhood).”

Mrs. Boyle has accused L-3/Engility of “criminal activities,” along with the insurers who have denied benefits under the policies Mr. Boyle purchased before his last deployment. “The claim file notes will include all documentation given by the employer, L-3, who is totally involved in this, too,” she said. “L-3 supplied the correct documentation to the insurance companies behind my back – they thought I would never suspect differently. And L-3 supplied the correct information so that they would benefit – the ‘janitor policies’ they took out on my husband and made themselves beneficiaries.”

The other companies, however, continue to deny that his death was accidental, maintaining that a “war risk exclusion” applied, negating a payout. “It’s kind-of odd to me that with one company, the ‘war risk’ exclusion does not apply, but the other company uses it as a defense,” Mrs. Boyle told us on Tuesday. “Again, I was told that once a decision by an insurance company is made, all others must follow the same protocol, meaning the same cause of death, same documentation, same information and that nothing new can be introduced or interpreted differently.”

Mrs. Boyle pointed out that the web page for Marsh, where her husband purchased his employer-based policy as well as the supplemental policies, did not divulge the policy exclusions which would be the “war risk” exclusion in this case; rather, they were found on L-3/Engility’s website. On July 10, The Post & Email quoted Mrs. Boyle as having explained, “They admitted that it wasn’t on that site, that it was on the personal page of L-3/Engility, so no one would know to go back and forth between the two sites to look for exclusions when signing up for insurance. You would think that what they offered to you is reliable, but in one email I discovered, they stated that because of this issue, we have now put the exclusion certificate ‘on the site’ – referring to the Marsh website where L-3 employees selected supplemental insurance coverage.”

She received a complete file from another source which contains documentation not released by the insurer. “In the claim notes, they’re discussing the war risk exclusion and why my husband would take out a policy knowing that it would never pay, then they realized through their research that the page where he purchased the insurance, the Marsh Personal Plan page, did not have the certificate nor the exclusions listed. “This is on the ‘Employer’ page,” Mrs. Boyle told us. “They admitted, and I remember that AIG/Chartis wrote that because of this claim, they have now changed it. They knew it was a mistake on their part and that my husband didn’t see it, and as I said earlier, any ambiguity is always ruled in favor of the client. But in this case, they chose to ignore it. I brought the issue that I have in my possession the emails admitting this mistake and wrote an email bringing this to their attention. They blatantly just refused to respond. These are the people we taxpayers bailed out,” Mrs. Boyle said, speaking of American International Group (AIG) and the TARP bailout of late 2008.

She further explained:

You have seen the email where their counsel says, “Let’s not talk about fraud.” These attorneys hide behind the fact that they consider themselves “officers of the court,” but based on their actions in response to every aspect of what I’ve uncovered regarding my husband, the attorneys have done the opposite. They’re not officers of the court; they’re officers of themselves. The benefit is always to the company.

Another individual insurance company from which there has been no response is Marsh. Marsh sent four checks to me that represent unexplained titles such as death claim refund all with different certificate numbers that remain to be explained to me. AIG we just talked about. Metlife told me to contact National Union Insurance regarding the incomplete claim note, citing “accidental homicide in Afghanistan 6/19/12 was accident.” I sent National Union a certified letter, and there’s still no response from them.

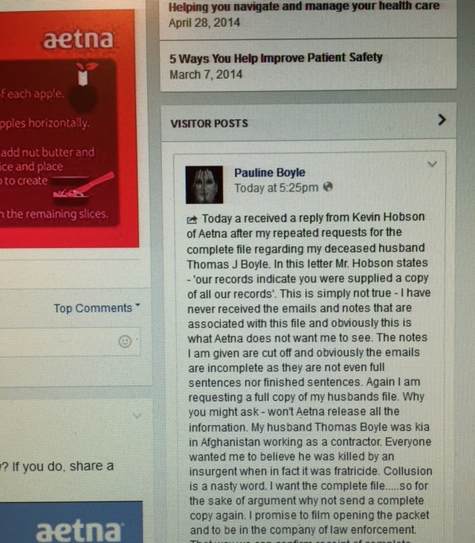

I seem to be getting better response from Aetna by posting on their Facebook page. That is why I am continuing on that level, because I’ve wasted my time and money sending certified letters; they’ve signed for them but don’t respond. Aetna has gone on and on saying, “We have given you everything.” Yet I still do not have the complete claim note in which it is written, “Death due to accidental injury.”

Every time they send me something again, they send a little bit more. They forget what they said before or what was sent. Within these notes there’s an application that was submitted by an employee of L-3/Engility in the Human Resources Department; her name is Tommie Jones. This person submitted the application in her handwriting to Aetna, which is a company-based policy; that’s not all that unusual. But with the term life and accidental death, they said, “Please provide the police and accident report,” and it’s checked off. Where’s the police and accident report? I didn’t see one, and I did not send a police or accident report to Aetna.

What they recently sent me is an “attachment” section mentioned in notes, and there’s no attachment included. It refers back to that 8-02-12 note where it says, “Accidental Death; War Risk does not apply.” You’ve seen that and published it. The next notation, though, is not complete, even though they say it is. It has a broken-off sentence. I want the complete notes, but they never give them to me. It goes on and on.

I’ve said to all of the insurance companies, “For the sake of honesty, send me the complete file with all of the complete emails and all complete claim notes once again, and I will open it in the presence of law enforcement while recording opening and searching for the email and notes in question. That way the contents will be documented. They can never say, again, they sent it to me, because if I open it and it’s not there, I’ve proven that these items were never sent.

Aetna and Metlife keep stating they have sent the entire file, but why would I keep asking for it if they had? And keep in mind that Marsh and AIG do not respond; however, AIG/Chartis should know that I possess the complete file since I have quoted incriminating emails to AIG employees/counsel. Yet all involved continue to ignore me.

[Editor’s Note: In a request placed on Metlife’s Facebook page dated August 9, Mrs. Boyle asked Metlife for the following:

[Editor’s Note: In a request placed on Metlife’s Facebook page dated August 9, Mrs. Boyle asked Metlife for the following:

This is about the death of my husband and the subsequent cover-up, and there is going to be accountability and the appropriate answers given to me. I deserve that much. I don’t understand how each and every one of them can sleep at night knowing that they’re covering this up.

This cover-up originates with the military who wish to keep the incompetence of the Reservists from the public. I have been told that base where my husband was working and eventually died was like “F-Troop.” The military did not want this to come out. I have documentation that Tom was shot twice by two different Reservists before the attack even started; some during the attack hid under desks and cried; all lied in their investigative report statements. The military spun quite the story but made the mistake of leaving his body intact, thinking that I would never question their story. As you know, I had my husband’s body exhumed and re-autopsied. And as I always maintained to you throughout these articles, I knew from the beginning that something was wrong. It’s all coming to a head now. The truth always comes out; it’s just a matter of time.

Getting back to the insurance companies and Metlife, they did send me a box which should have included the entire file I requested, but the contents did not contain all the claim notes and emails. They didn’t even include my emails to them, which would have been apparent within a copy of the “entire file.” As I said, they always include something they don’t think is relevant, but the most appalling thing within the notes is the Claim Contact History Inquiry in one notation.

Of course, Metlife says nothing about that blurb in their claim notes where it says “Accidental Homicide.” They refuse to expound on that at all. However, another interesting aspect is noted in the Claim Contact History Inquiry dated 08-22-12, two months after my husband died, it says:

Amount Claimed and Marsh advises $XXXK at MEOI level; however, this is not what master plan indicates. PM is 3 times the base salary.

So they paid me a lesser amount than what I should have gotten and then said that they changed the plan. This is one of the first claim notes; it’s dated 8/1/2012, and it says under Comments: “OK to proceed using plan change.” Metlife just arbitrarily changed the insurance plan.

Tom had increased the amount of several policies and then deployed – I know this because Tom called to tell me. He said he would forward the documents when he reached Afghanistan. Soon after that, I received some mail for Tom from Metlife. I kept it for him to open later. I didn’t even open it. There was nothing I could do in either case since I was the beneficiary. In the envelope was a letter confirming he had upgraded the insurance coverage, but they needed a health questionnaire filled out by him to complete it. Metlife mailed it to our home. Tom was deployed already, so he never saw the questionnaire. He never received the questionnaire. Because this questionnaire was not supplied, the increase was denied. So why would there not be a pop-up when signing up for insurance that would indicate a health questionnaire needed to be filled out in order to validate the policy increase?

Once again, if you look it up anywhere, any ambiguity with an insurance policy is decided in favor of the client.

There’s another one on 8/10/2012 in a claim contact. I’m sure these are claim notes, but the one where they state “Accidental Homicide” is not complete; it’s not included. In the Comments, it further states, “E.D. Deceased in Afghanistan in the military. There’s a casualty report via fax on 8/3 per examiner sending two additional comments.

So they have a casualty report, but the original casualty report is the preliminary which confirms that more documents would be forthcoming. Again, that something forthcoming had to have originated with the employer. It was a document that I never saw.

Once again as I am informed, any ambiguity should have gone in my favor, but it didn’t. So Metlife squirmed out of paying what they should have. When they tried to defend the result, I would respond, “He didn’t fill out the questionnaire because he didn’t know about it.” Tom never received the questionnaire so that he could fill it out.

There’s another notation on 8/6 saying that “other docs received on 8/3.” But the notes don’t verify which documents are included. That is sloppy record-keeping, to say the very least, if not intentionally misleading.

Then Metlife stated that they talked to me on – and it’s created on 7/30/2012 – and it says, “Comments: (They have me named) She will be sending in something for accident.” How could I have sent in something for “accident” when I didn’t know it was an accident? At that time I was told my husband was killed by insurgents. How is that called an accident? If insurgents killed my husband it certainly was not by accident.

I think the employees taking the claim notes may have thought I already knew it was an accident because they were already told it was an accident. Or perhaps they were falsifying the record. As I said, the truth always comes out; it’s only a matter of when.