by Cauf Skiviers, Cultural Inappropriation, ©2023

(Aug. 23, 2023) —

“I go on the principle that a public debt is a public curse and in a republican government more than in any other.”

James Madison

The next milestone in the illustrious track record of Bidenomics will be a government shutdown later this year. That’s the conclusion the investment bank Goldman Sachs reached in a report to private clients earlier this week. The bank notes that a government shutdown has looked “fairly likely” since the debt limit deal and points to four key culprits for the crisis to come:

- Sky-high spending levels;

- Massive wealth transfers to Ukraine;

- Funding for Justice Department weaponisation; and

- Refusal to tighten border security.

Of course, the four culprits share a common denominator: they are all core tenets of Bidenomics.

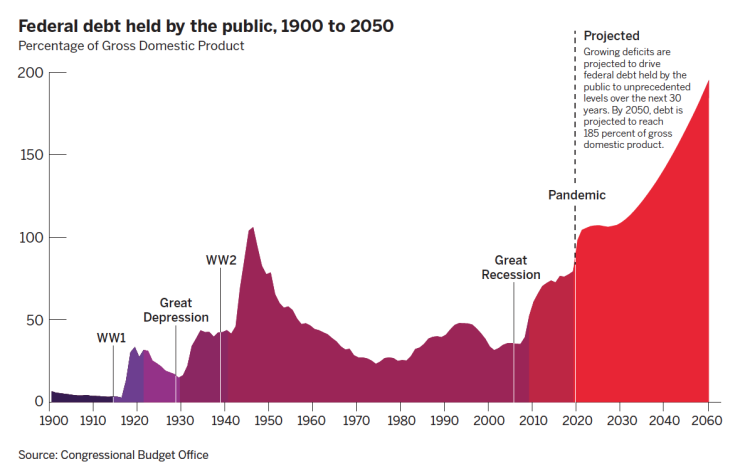

While the response to Covid represented an unprecedented shift from the previous dynamics in terms of budget deficits and government debt, it is the Biden Regime’s brinkmanship in managing the economy between the twin cliffs of runaway inflation and economic stagnation that set both the US public debt outstanding and budget deficits on explosive trajectories. So, it is up to Congress to throw a spanner in the works of Bidenomics and prevent a further disaster.

As Goldman Sachs points out, “beyond the divide on spending, several policy issues are likely to slow spending legislation and could potentially stall it altogether. The most obvious is funding for Ukraine.”

A new element that Bidenomics introduced at the core of U.S. budget decisions (perhaps inspired by the Biden’s decades-long expertise on dubious deals in the country), Congress has so far approved $113 billion for Ukraine, including $67 billion in military aid, which will run out in the next couple of months, according to the bank’s analysts.

And the Biden White House is seeking a further $24 billion for Ukraine, as part of a larger $40 billion supplemental spending package. Like other types of ‘emergency’ spending, these funds would be exempt from the caps established under the Fiscal Responsibility Act of 2023. The surge in funding for Ukraine flies in the face of popular support, with a recent poll from none other than CNN finding that 55% of Americans are against it:

“Overall, 55% say the US Congress should not authorize additional funding to support Ukraine […] and 51% say that the US has already done enough to help Ukraine.”

On the domestic front, House Judiciary Committee Chairman Jim Jordan (R-OH) has recently written a letter to the House Appropriations Committee with common-sense recommendations to reduce spending, constrain out-of-control federal agencies, hold the Biden Administration accountable, and protect fundamental civil liberties:

Immigration enforcement and border security. The Committee recommends prohibiting taxpayer dollars from being used to implement the Biden Administration’s radical immigration policies.

Reining in abusive federal law enforcement agencies. [The Committee] recommend that the appropriations bills eliminate any funding for the FBI that is not absolutely essential for the agency to execute its mission.

Protecting Freedom of Speech online. [The Committee] request language in fiscal year 2024 appropriations bills prohibiting taxpayer funds from being used to censor Americans online or to classify speech as so-called ‘mis-, dis-, or mal-information.’ [and] eliminate taxpayer dollars going to the Global Engagement Center and other governmental and non-governmental entities that are engaged in speech suppression.

Goldman Sachs, rightly so, identifies the Republican requests for increased border security, ceasing the weaponisation of the DoJ, and protecting free speech as issues that “could hinder progress” when it comes to budget and fiscal policies underpinning Bidenomics.

The Bidenomics Downgrade

“For every tree is known by its fruit. For men do not gather figs from thorns; nor from a bramble bush do they gather the grape.”

Luke 6:44

Earlier this month, Bidenomics earned yet another shiny new milestone: Biden’s erratic fiscal policy was awarded the dubious honour of only the second downgrade to the U.S. debt credit rating in the nation’s 247-year history. The other downgrade was achieved by its older sibling, Obamanomics, in 2011. Commenting on the downgrade, the House Committee on the Budget outlines the rationale behind Fitch Ratings’ decision:

“Spending and debt is unsustainable; interest costs are out of control; inflation and interest rate hikes have weakened our economy; we will be in recession by the end of the year; the fiscal outlook only gets worse; our debt-to-GDP has hurt U.S.’s ability to absorb a major financial shock in the future; and if we don’t change course, the U.S. will not only incur another credit downgrade, we will undermine the dollar as the global reserve currency.”

This downgrade sees the US economy exit the club of top-rated economies in the world to join the ranks of New Zealand, Taiwan, and Finland. This demotion will inevitably lead to higher interest rates and borrowing costs in the future.

Read the rest here.