“OH, WHAT A TANGLED WEB WE WEAVE…WHEN FIRST WE PRACTICE TO DECEIVE”

by Sharon Rondeau

(Jun. 5, 2016) — For the past four years, Pauline Boyle has been attempting to discover the truth behind her husband’s death in Afghanistan following an attack by Islamic insurgents on the provincial reserve (PR) where he was employed as a civilian contractor.

(Jun. 5, 2016) — For the past four years, Pauline Boyle has been attempting to discover the truth behind her husband’s death in Afghanistan following an attack by Islamic insurgents on the provincial reserve (PR) where he was employed as a civilian contractor.

Thomas J. Boyle, Jr. had spent 30 years in the Chicago Police Department, from which he retired in 2001, then had gone to work for MPRI/Engility, a division of L-3 Communications based in Alexandria, VA, to train overseas police officers. He was a decorated two-tour veteran of the U.S. Marines during the Vietnam War.

Hundreds of contractors have been killed in Afghanistan and Iraq during the protracted wars which began in October 2001 and March 2003, respectively, as part of then-President George W. Bush’s actions in the “War on Terror” following the September 11, 2001 attacks on the United States. On September 23, 2010, ProPublica reported that contractor deaths surpassed military deaths in Iraq and Afghanistan that year.

Mr. Boyle was employed by a company called MPRI, which became Engility Corp., a subsidiary of L-3 Communications Corporation.

Mrs. Boyle is convinced, through eyewitness accounts related to her in private, that her husband was killed by two soldiers in a “friendly-fire” incident while deployed by the 303rd Battalion of the U.S. Army Reserve in the wake of the insurgent attack on June 19, 2012, which resulted in multiple deaths and injuries.

The U.S. Army has not explained to Mrs. Boyle exactly how her husband died, and she has been issued three different death certificates with as many causes of death. She believes that the facts have been obscured so as to protect the perpetrators from disciplinary action, which could include court-martial and thereby making their alleged actions public knowledge.

Mrs. Boyle classifies her husband’s death as “fratricide.” Referring to the Army’s investigative report, referred to as a “15-6,” she told The Post & Email, “There exist two separate 15-6’s about this incident – one is the true accounting and the other is the sanitized report.”

In an earlier interview, Mrs. Boyle reported that a U.S. intelligence agent later told her that the circumstances of her husband’s death were “just like Benghazi” in that additional security had been requested by the commander in charge of the base but not supplied. On September 11, 2012, a terrorist attack on a CIA compound in Benghazi, Libya killed four Americans, including U.S. Ambassador to Libya J. Christopher Stevens. During subsequent congressional hearings on the attack, individuals stationed in Tripoli and elsewhere in the region testified that Stevens had “pleaded with the State Department for additional security personnel” in the months leading up to the attack, to no avail.

Mrs. Boyle believes that like Benghazi, “The media would have been all over it had the facts surrounding my husband’s death been made public.”

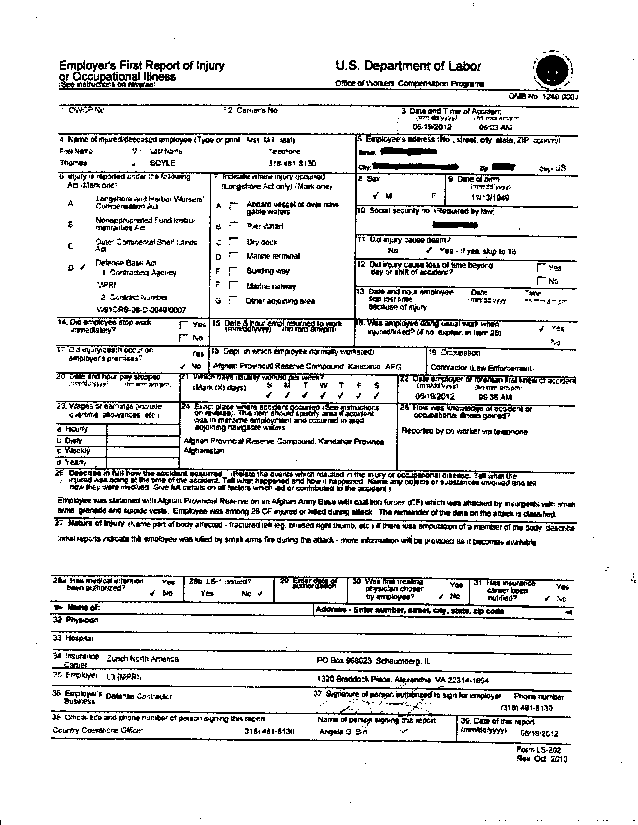

The initial report sent to the U.S. Department of Labor by Engility/L-3 after the attack at the PR states that Mr. Boyle “was stationed with Afghan Provincial Reserve on an Afghan Army Base with coalition forces (CF) which was attacked by insurgents with small arms, grenades and suicide vests. Employee was among 26 CF injured or killed during the attack. The remainder of the data on the attack is classified.”

Mrs. Boyle believes that the military pressured Engility/L-3 with “no more contracts” if the company were to reveal what actually occurred and that L-3 then withheld the information from Mrs. Boyle. She has made the case that the true cause of death was supplied to some of the insurance companies involved by L-3 in order to collect “janitor” policies for their own financial gain, while payouts she would have expected have been withheld from her.

Because L-3 Communications would not provide documentation and the Army would not answer her questions, Mrs. Boyle took the painful step of having her husband’s body exhumed for a second, non-military and independent autopsy.

Mrs. Boyle told The Post & Email that the results of the second autopsy showed that the testimony given by soldiers on the base regarding how Mr. Boyle died “is thrown out the window” because of the reported trajectories of the gunshots and the resultant damage. She said that contrary to several soldiers’ statements that Mr. Boyle was seen running after being shot,…”they are lying. No one saw him get up after being shot by the second shooter. It was impossible.” It was also determined that there existed more entrance wounds than exit wounds yet, the Armed Forces Medical Examiner (AFME) denied removal of any bullets or fragments.

Mrs. Boyle additionally told The Post & Email that the two soldiers she alleges killed her husband “moved and staged my husband’s body at the order of command to cover up their ineptitude. In doing so they betrayed my husband, as did everyone else involved in the cover-up. Every soldier on base the day of the attack knows what happened, every one of them.” “My husband has been betrayed by the military police, the military, his employer, soldiers on base, everyone,” she said.

In addition to L-3, Mrs. Boyle has confronted the several insurance companies from whom her husband had purchased life and accidental death and dismemberment (AD&D) policies prior to his last deployment. Last week, she told The Post & Email that she believes the companies – AIG, Metlife, and Marsh & McLennan as the administrator – are purposely concealing the cause of death which curiously, Aetna found to be “accidental bodily injury” and issued a payout thereon. However, Aetna has refused to supply Mrs. Boyle the entire administrative file which she has requested numerous times, which she claims is in direct contrast to federal statute. “The beneficiary has the right to request and receive the entire file, which would have the entire email communication in which it is stated that the ‘act of war limitation does not apply – death due to accidental bodily injury,'” Mrs. Boyle said.

Mrs. Boyle reported that AIG claimed that a “war risk exclusion” applied and denied payment. However, Mrs. Boyle said that she was told by an attorney with whom she was working that “Once a determination regarding policy processing is made, all other policies must follow suit.”

While notes accompanying Aetna’s printout say that Mr. Boyle’s death was due to accidental bodily injury, notes from a Metlife printout state, “…was accidental homicide in Afghanistan on 6/19/12 was accident.”

[Editor’s Note: The Post & Email has seen but is not able to publish all of the communications Mrs. Boyle has received, as many of them contain a privacy disclaimer.]

“How are they able to deny the cause of death?” we asked Mrs. Boyle, to which she responded, “Because if they admitted there was an accidental death, I would have to ask ‘Why?’ and then the fratricide would come out.”

At the end of March, Mrs. Boyle sent letters by certified mail to all of the insurance companies involved. In explanation to The Post & Email, she said:

I sent one to Aetna, and they responded, but they never addressed the email which says that at the time of his death, the “act of war limitation does not apply. Death due to accidental bodily injury.” I’ve spoken to Aetna representatives within the past 2-3 weeks, asking for the complete email. Then they started to tell me that they are allowed only so many “characters,” and I said, “There’s a complete email in here, because it’s cut off. Where did you get this documentation?” Then, of course, what they sent me is totally irrelevant. Again, I am never given the entire administrative file I have requested.

The only entity that could have supplied the true cause of death would be L-3 Communications’ HR Department. When I asked them, “How did you arrive at the ‘accidental death’ determination?” I am told that “accidental death” means that any time someone is killed, it’s an accidental death because you don’t plan on being murdered.” I responded to that with, “You don’t really expect me to believe that, do you?”

Aetna has never given me the entire file and did not address or provide information about the “accidental death.”

The other policies in question begin with Marsh McClennan, the administrator for the Metlife and AIG policies.

Mrs. Boyle received four checks from Marsh & McLennan which she believes were issued to relieve the insurance companies involved of the responsibility of having to issue a payout. (Pictured below are two of the four check stubs.)

In January 2014, Mrs. Boyle received a letter from Marsh & McLennan stating that the checks had not been cashed and asking if they had ever been received and/or deposited. Mrs. Boyle told The Post & Email that she purposely did not cash the checks.

She then explained:

Marsh received my recent request for clarification of these checks via certified letter on March 31; I’ve not received a response. These checks represent something. The certificate numbers are different, which means different policies, and one is a death claim refund; the other is a death claim “surrender.” But they’re all different certificate numbers, which leads me to believe there are other policies out there I am not aware of. They are referred to as “companion policies.”

Marsh is the administrator over the MetLife and AIG policies, and what they should have done was distribute all of the information to those two companies. We already know through the communications presented above that MetLife knows about the accidental death – it’s mentioned in their own email. By statute, Marsh, as the administrator for AIG, was obligated to forward the accidental death information to AIG. There is no mention of this in any AIG correspondence that I have been given, yet this information was clearly provided to Metlife.

MetLife signed for their certified letter on 4/1/2016 and has never replied to the recent correspondence.

In a previous letter to me, Metlife wrote, “While it appears that your late husband did have Personal Accidental Insurance (PAI) through his employer L-3 Communications Corporation, MetLife does not ensure the PAI benefits, AIG does.”

To further confirm the communications among all of the parties, I have supplied an email dated 4/16/2013 whose subject is “T. Boyle” from Debra Wasson of Marsh distributed to Jack Mikolajewski of Metlife; Jack Savulch of AJG, Arthur J. Gallagher, a global brokerage for commercial insurance; Debra Bosman; Elizabeth Scott; Cristina Potter; all of Engility/L-3; Dennis Chartier of Marsh; Kurt Moegle of AIG; and lastly, Tom Kelly of Wells Fargo, which is another unknown entity involved.

The content of the email will be saved for a later date, but the purpose herein is that all the insurance companies and the employer, Engility, are communicating regarding processing. I have no knowledge of Arthur Gallagher’s involvement nor Wells Fargo’s but will state they are most likely related to those uncashed checks which correspond to some policy I am not privy to.

Additionally, I have supplied a redacted copy of a letter from Mercer regarding an uncashed check and certificate number. Another insurance company I was never privy to their existence in the matter of my husband let alone their involvement.

AIG/Chartis received their certified letter on April 4, 2016 requesting the entire administrative file to which I am entitled. In it, Ms. Kimberly Miller wrote, “The additional information you have requested is not part of the administrative record, and as a result, we will not release that information to you.” This is not true; as beneficiary I am entitled to these copies and there exists no attorney-client privilege related to this issue and processing.

With regard to the policy No. PAI 9132929, it actually was underwritten by National Union Fire Insurance Co. of Pittsburgh, PA. So AIG is informing me of another policy and who it is held by – further confirming the corroboration of the insurance companies.

Mrs. Boyle recently told The Post & Email that she has received a copy of the entire administrative file from a third party. Within the complete file, Mrs. Boyle shared how she believes she was “sold out” by the insurance companies as well as L-3/Engility.

“My husband signed up for various insurance policies through the employee portal provided by L-3/Engility. Within the real AIG administrative file discussion, it is noted that the excluded countries named in the war risk exclusion are not located on the Marsh website where Tom purchased the policy. Rather, the war risk rider is available in the certificate which was located on the L-3/Engility website. A copy of the certificate was mailed five days after purchase to our home. But Tom was already deployed to Afghanistan, so he never opened the welcome packet. Afghanistan was one of the countries excluded from coverage. Engility clearly knew where they were sending my husband.”

Her new discoveries, after receiving the administrative file from the third party, include:

- There is reference to the AIG policy that “I see a lot of cancellation with renewals and then cancellations again.”

- Reference is made on 8/6/2012 that I stated to the AIG agent that I was not sure if I was being told the truth about my husband’s death.

- There is a reference in an email stating that it just doesn’t make sense that someone would get that rider (referring to the war risk exclusion) knowing that basically every troublesome country would be excluded.

- There is a reference that Mr. Boyle was not excluded for accidental death coverage while in Afghanistan. If he died due to injuries sustained in any number of different accident scenarios (car wreck, falling from a height, accidentally discharging his weapon, etc.), he would have been covered. He was excluded from coverage only since it happened to be due to an act of declared war or undeclared war.

- There is a reference that the certificate stating the excluded coverage was not on the Marsh website where Tom applied for this insurance, but as a result of this claim, the certificate was placed on the Marsh website.

- Reference is made in emails that admittedly all those involved in processing the AIG claim “do not know the actual circumstances involved in his death.”

- Reference is made requesting “legal reserve for coverage opinion.”

- Reference is made about another “companion claim.”

“So AIG processed a claim without knowledge of the circumstances of his death, admitted that my husband did not have access to the exclusions and certificate at the time of purchase, admitted to placing the certificate/exclusions online – ‘as a result of this claim,’ and the list goes on and on,” Mrs. Boyle said. “I ask you, who has the burden of proof? That answer falls clearly on the shoulders of all the insurance companies. Is this not fraud?

“In addition to the AIG letter from Ms. Miller (pictured below), there exists a draft within the real administrative file in which AIG originally states that they would be happy to review new information upon completion of the second autopsy and additional investigation. Somehow that sentence was deleted by the time it was forwarded to me.

On several occasions, Mrs. Boyle has asked L-3 Communications for her husband’s full employment record but has yet to receive it. She further expounded:

On several occasions, Mrs. Boyle has asked L-3 Communications for her husband’s full employment record but has yet to receive it. She further expounded:

I have an email dated 8/21/2012 from Pearl Mihara, former senior VP of HR at Engility, wherein she verifies that it was an enemy attack and that the casualty report given to AIG would be the most sufficient document to state the cause of death and circumstances. She said the government will take a very long time to get any other paperwork out and that it would not say any more than that.

I allege that Ms. Mihara intentionally deceived AIG by misinforming their agents regarding the cause of death. The dates of the Aetna and Metlife emails preceded her email to Aetna. Even more important is the fact that the accidental death information could have come only from one place: Engility.

L-3 is number one in this cover-up; they did it to keep their contracts with the military and for their own financial gain through “janitor insurance policies.” Engility continues to make billions of dollars in taxpayer money.

Oddly, L-3 contacted the Department of Labor regarding Tom’s death on the day he died, and the paperwork went through before I was even informed of his death. At 10:41 a.m. on June 19, 2012, Engility employees were already faxing this information to the Department of Labor. I would wager they have the documentation on the true cause of death also. Engility used their office number as my husband’s home phone number in the paperwork. They had our home number; why would they do that? Perhaps to deflect questions from the Department of Labor? I had not been informed of Tom’s death, but already the wheels were turning. How many other people has this happened to? How many families have been defrauded?

Mrs. Boyle has sent The Post & Email’s articles about her husband’s story to several members of the U.S. House of Representatives, including Oversight and Government Reform Committee Chairman Rep. Jason Chaffetz and Chairman of the Select Committee on Benghazi, Trey Gowdy.